Color-coded filing systems: Reduce downtime and increase ROI – Part 1

In 1967, TAB launched CompuColor® labeling products for use in computer punch cards. Forty-five years later, punch cards are computing history, but color-coded filing techniques are still an integral part of effective information management. What is it that allows color-coding to transcend its original purpose and remain popular five decades later? How can it remain a critical records management tool in the new age of privacy legislation, growing environmental scrutiny and soaring real estate costs? This 2-part blog post answers those questions by returning to the basic principles of color-coded filing and applying those principles to the everyday realities of managing business information in the 21st century.

|

Part 1 shows you how color-coding works and who it benefits. It also makes the business case for color-coding by demonstrating how it leads to:

- more efficient records retrieval, retention and disposition

- improved decision-making

- less operational downtime

- fewer lost opportunities and

- minimized risk of legal sanctions

1.0 How does color-coding work?

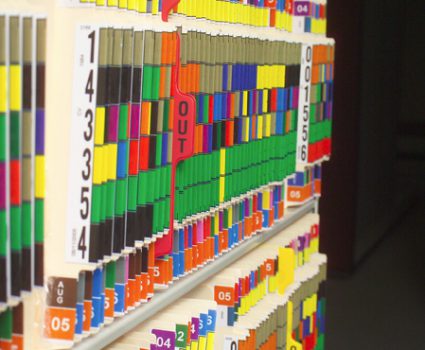

At its most basic, color-coding assigns standard colors to different label elements. Each digit from 0 to 9 corresponds to its own standard color, as does each letter from A to Z. The colors provide users with a visual cue that works faster than text alone. Most people will have seen color-coding at work in their doctor’s office. While health records management is not the only application of color-coded filing, it is certainly an effective example of how the system works. File folders are arranged from left to right with color-coded labels for patient numbers attached to the end of the folders and facing the front of the storage system. This creates blocks of color, as all file numbers beginning with the number 1 (e.g. 1000-1999) start with the same color, and all files beginning with the number 2 start with another color and so on. All files placed in the wrong block of numbering should be instantly recognizable to staff as a break in the color pattern, avoiding the inefficiency and risks associated with not being able to find that file later.

1.1 What businesses can benefit from color-coding?

Here are just some of the more common applications of color-coded filing in today’s business environment:

- case files in a law firm

- client files in a financial services company

- policy files in an insurance company

- project files in an architectural, engineering and / or consulting setting

- natural resource asset files organized by an industry-recognized identification number

- employee-specific files held by a human resources or occupational health and safety department

2.0 The business case for color-coding

So how exactly does color-coding improve your RIM program and overall operations? The business case is clear.

2.1 Records retrieval and decision making

Color-coding improves the reliability of business information by making it easier to locate a given file on the shelf and proactively addressing the risk of misfiles. Effective records retrieval is as much about risk management and legal compliance as it is about everyday convenience:

- As a source of information, records directly participate in decision making, transactions and communications.

- Secondly, records provide legal evidence of business activities and may be needed later to account for those activities in a lawsuit, audit or other sensitive situation.

Given the integral role of records in business, slow or unreliable retrieval can mean dire consequences for an organization. Realistic worst-case scenarios include:

2.2 Operational downtime

Accountants cannot do their work without receipts, invoices and other financial records. Engineers cannot do their work without design documents, materials specifications and construction drawings. The list goes on. The cost implications of this scenario are disturbing, as expensive professional and technical resources spend hours searching for records or recreating lost information. Even those costs can appear small compared with the profits lost when a business comes to a standstill.

2.3 Lost opportunities

Success in many different sectors depends on a company’s ability to acquire the right assets at the right time. Asset acquisition can range from entire corporations to land-based natural resources and joint operating rights. For the company selling the asset, keeping prospective buyers interested means providing all relevant information about the asset and answering questions in a timely manner. The buyers themselves may need to gather their own information. Still other records may need to be produced at the demand of regulators responsible for approving the merger, acquisition or divestiture. With a long line of competing suitors eager to acquire the asset, no buyer wants to tell a regulator or prospective business partner to come back later for records.

2.4 Legal sanctions

The laws of virtually every legal jurisdiction in the world contain serious requirements for the creation, submission and auditing of critical business documents. As just one example, the Sarbanes-Oxley Act of the United States contains detailed reporting requirements to ensure that publicly traded companies are accountable to securities regulators. Organizations in virtually every line of business must be accountable to legislated authorities and respond to periodic audits around issues such as environmental impact, personal safety and taxation. Records information is critical to demonstrate compliance and / or support claims. The inability to do so can result in:

- hefty fines,

- punitive damages,

- imprisonment,

- damaged relations with customers, investors and the general public.

3.0 Records retention and disposition

At their most direct, laws may specify which documents must be retained and for how long. Other legal requirements are more indirect. Without mentioning records, a law can imply a retention period in the form of limitation periods for lawsuits, monetary claims and audits. As long as legal action is possible, records may need to be called upon as evidence. As every sector of business becomes more information-driven, traditional records retention requirements are sharing space in law libraries with entire statutes and regulations concerned primarily with how information is documented, stored and used. Corporate reporting laws, such as the Sarbanes Oxley Act of the United States, have placed an increased emphasis on records as a source of accountability. Sarbanes-Oxley is especially clear on this point, as any person who “alters, destroys, mutilates, or conceals a record … with the intent to impair the object’s integrity or availability for use in an official proceeding” may receive a heavy fine, up to 20 years in prison, or both.

3.1 Privacy law

While the details may differ from one place to the next, the basic theme of most privacy laws for records retention is increased responsibility for ensuring that records are kept long enough, but not too long. Individuals have the express legal right to access recorded information about themselves, with certain exceptions. An organization must, therefore, take reasonable steps to retain personal information long enough for a subject to exercise their right of access. On the other hand, it is a breach of privacy to retain personal information for too long.

3.2 Retention periods

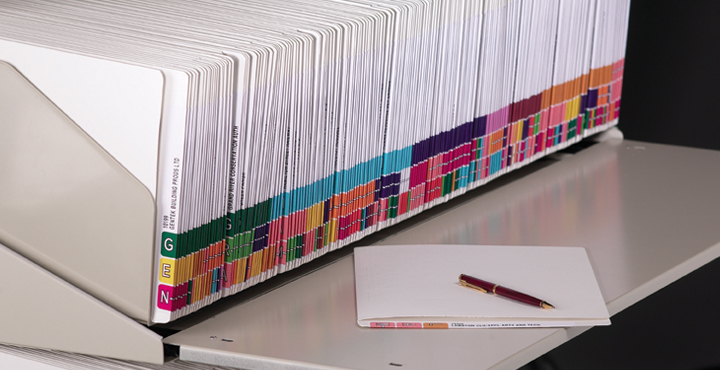

For any records manager attempting to schedule retention periods for different categories of information, these legal developments make it more important than ever that they do their job right. A carefully researched records classification and retention schedule is critical to identifying those retention periods, but as a tool it is useless as long as it sits idle on a shelf or is applied carelessly. As a reliable means of identifying file content, color-coded systems can play a central role in regular application of records retention periods. By identifying files more clearly, color-coding reduces the risk of the wrong file being destroyed during an annual purge. If a file is mistakenly shelved with a batch of older files, the break in color pattern will help staff catch it. Color-coding can also play a direct role in making the retention process easier and more efficient. This is especially true for any chronologically arranged file series whose retention period is based on the end of the year in which the files were created. Color-coding helps users to quickly identify the block of eligible files to be pulled from active storage. Records retention periods are applied accurately and on time, mitigating the compliance risks associated with both insufficient and excessive retention.

Next Steps

- Read part 2 on how color-coding improves records privacy and information security, as well as space management

- Download our white paper “Optimize Your Records Management Program with Color-Coding”

- Read our case study to find out how we helped one company save $250k with automated color-coding

- Contact a TAB representative to see how color-coding can help your organization

- Purchase your TAB CompuColor highly-customized, factory-printed file labels.